Question: Normal and abnormal spoiled units with salvage value The lubricating compound pro- duced by Rogets Manufacturing must pass a final quality control inspection before transfer

Normal and abnormal spoiled units with salvage value The lubricating compound pro- duced by Rogets Manufacturing must pass a final quality control inspection before transfer to the finished goods inventory. Although quality standards are quite high, the manufacturing activity is well managed and employees are highly skilled. As a result the company does not expect to experience more than 150 units of spoilage in any particular month. Any amount greater than 150 units in a month is treated as abnormal spoilage. Company policy dictates the reporting of a separate spoiled unit cost.

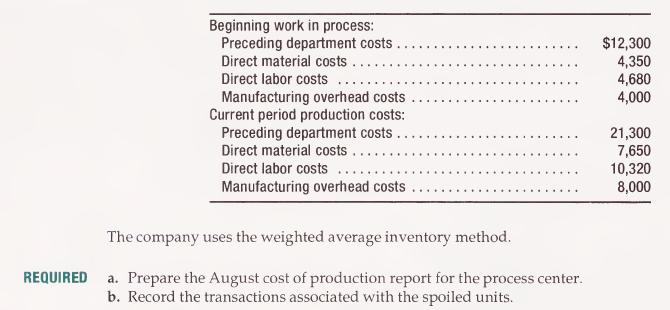

During August 3,000 units were in beginning work in process in the last process center with all material and % conversion. 5,000 units were transferred in from the preceding process center. Ending work in process inventory was 2,500 units complete in terms of material and 1/5 con- verted. During August, 400 units were rejected at inspection. The rejected units were sold for $3.40 per unit. August production costs included;

Computer requirement Management has been evaluating its position on normal spoilage. Some personnel have argued that any spoilage is unacceptable and should not be treated as normal product costs. Others have argued spoilage is unavoidable and all spoilage should be treated as normal. A second issue is the salvage value for the spoiled units. Recently, it has been hard to find buyers for the spoiled units. There is some chance the market for spoiled units may disappear.

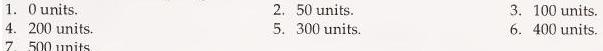

c. Compute the cost per unit and total cost of units transferred out during August assuming both no salvage value for spoiled units and the current salvage value for spoiled units, and assume the acceptable level of spoilage is:

Beginning work in process: Preceding department costs. Direct material costs... Direct labor costs Manufacturing overhead costs Current period production costs: Preceding department costs. Direct material costs... $12,300 4,350 4,680 4,000 21,300 7,650 10,320 8,000 REQUIRED Direct labor costs Manufacturing overhead costs The company uses the weighted average inventory method. a. Prepare the August cost of production report for the process center. b. Record the transactions associated with the spoiled units.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts