Question: Preparing an income statement using absorption and direct costing. The Ellsworth Manufacturing Company makes one product. The company uses standard costing. During the year 19X5,

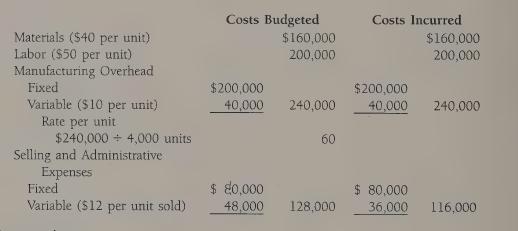

Preparing an income statement using absorption and direct costing. The Ellsworth Manufacturing Company makes one product. The company uses standard costing. During the year 19X5, the normal volume of 4,000 units was produced, and 3,000 units were sold for $200 each. Assume that there was no beginning inventory on January 1, 19X5. The following data are provided for the year 19X5:

Instructions 1. Prepare an income statement for the year 19X5 using absorption costing.

2. Prepare an income statement for the year 19X5 using direct costing.

3. Prepare a reconciliation of the net income under direct costing and absorption costing.

Materials ($40 per unit) Labor ($50 per unit) Manufacturing Overhead Fixed Costs Budgeted $160,000 Costs Incurred $160,000 200,000 200,000 $200,000 $200,000 Variable ($10 per unit) 40,000 240,000 40,000 240,000 Rate per unit $240,000 4,000 units 60 Selling and Administrative Expenses Fixed Variable ($12 per unit sold) $ 80,000 $ 80,000 48,000 128,000 36,000 116,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts