Question: Using the high-low points method and the method of least squares. The direct labor hours and payroll taxes and fringe benefits of the Moreland Company

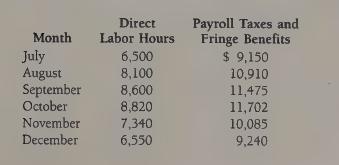

Using the high-low points method and the method of least squares. The direct labor hours and payroll taxes and fringe benefits of the Moreland Company for six months during 19X0 are shown below.

Instructions 1. Using the high-low points method, compute the variable rate per direct labor hour and the fixed cost per month for payroll taxes and fringe benefits. (Round the variable costs to the nearest tenth of a cent per hour and the fixed costs to the nearest whole dollar per month.)

2. Using the method of least squares, compute the variable rate per direct labor hour and the fixed cost per month for payroll taxes and fringe benefits. (Round the variable costs to the nearest tenth of a cent per hour and the fixed costs to the nearest whole dollar per month.)

Month Direct Labor Hours Payroll Taxes and Fringe Benefits July 6,500 August 8,100 $ 9,150 10,910 September 8,600 11,475 October 8,820 11,702 November 7,340 10,085 December 6,550 9,240

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts