Question: Variable and fixed cost analysis; high-low method LO 2 Combustion Company manufactures a product that requires the use of a considerable amount of natural gas

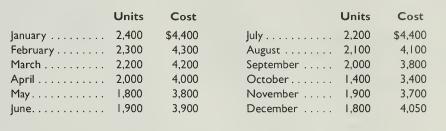

Variable and fixed cost analysis; high-low method LO2 Combustion Company manufactures a product that requires the use of a considerable amount of natural gas to heat it to a desired temperature. The process requires a constant level of heat, so the furnaces are maintained at a set temperature for 24 hours a day. Although units are not continuously processed, management desires that the variable cost be charged directly to the product and the fixed cost to the factory overhead. The following data have been collected for the year:

Required:

1 .

Separate the variable and fixed elements, using the high-low method.

2. Determine the cost to be charged to the product for the year. (Hint: First determine the number of annual units produced.)

3. Determine the cost to be charged to factory overhead for the year.

Units Cost Units Cost January February. ... 2,400 $4,400 July... 2.200 $4,400 2,300 4,300 August... 2,100 4,100 March 2,200 4,200 September 2,000 3,800 April 2,000 4,000 October.. 1,400 3,400 May.. 1,800. 3,800 November 1,900 3,700 June. 1,900 3,900 December ... 1,800 4,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts