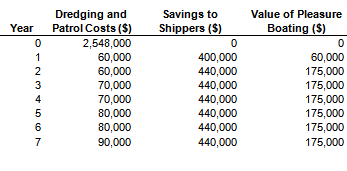

The following table gives cost and benefit estimates in real dollars for dredging a navigable channel from

Question:

The channel would be navigable for seven years, after which silting would render it un-navigable. Local economists estimate that 75 percent of the savings to shippers would be directly invested by the firms, or their shareholders, and the remaining 25 percent would be used by shareholders for consumption. They also determine that all government expenditures come at the expense of private investment. The marginal social rate of time preference is assumed to be 3.5 percent, the marginal rate of return on private investment is assumed to be 6.8 percent, and the shadow price of capital is assumed to be 2.2.

Assuming that the costs and benefits accrue at the end of the year they straddle and using the market-based interest rate approach, calculate the present value of net benefits of the project using each of the following methods:

a. Discount at the rates suggested by the U.S. Office of Management and Budget.

b. Discount using the shadow price of capital method.

c. Discount using the shadow price of capital method. However, now assume that the social marginal rate of time preference is 2.0 percent, rather than 3.5 percent.

d. Discount using the shadow price of capital method. However, now assume that the shadow price of capital is given by equation (10.9). Again assume that the social marginal rate of time preference is 3.5 percent.

e. Discount using the shadow price of capital method. However, now assume that only 50 percent of the saving to shippers would be directly invested by the firms or their shareholders, rather than 75 percent. Again assume that the social marginal rate of time preference is 3.5 percent and that the shadow price of capital is 2.2.

Step by Step Answer:

Cost-Benefit Analysis Concepts and Practice

ISBN: 978-1108401296

5th edition

Authors: Anthony E. Boardman, David H. Greenberg, Aidan R. Vining, David L. Weimer