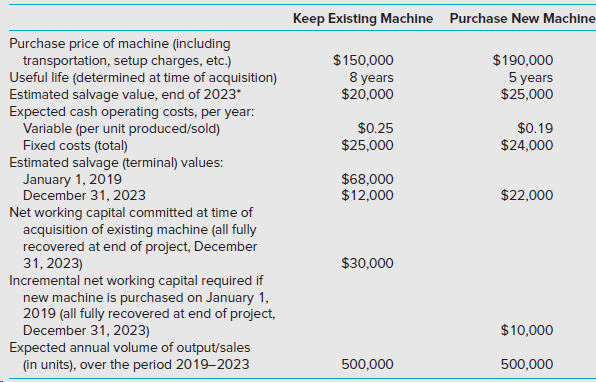

Assume that it is January 1, 2019, and that the Mendoza Company is considering the replacement of

Question:

Assume further that Mendoza is subject to a 40% income tax, both for ordinary income and gains/ losses associated with disposal of machinery, and that all cash flows occur at the end of the year, except for the initial investment. Assume that straight-line depreciation is used for tax purposes and that any tax associated with the disposal of machinery occurs at the same time of the related transaction.

Required

Determine the relevant cash flows (after-tax) at:

(1) time of purchase of the new machine (i.e., time 0: January 1, 2019),

(2) Determine the relevant (after-tax) cash inflow each year of project operation (i.e., at the end of each of years 1 through 5),

(3) Determine the relevant (after-tax) cash inflow at the end of the project€™s life (i.e., at the project€™s disposal time, December 31, 2023),

(4) Identify any irrelevant cost and revenue data associated with this asset-replacement decision,

(5) Determine the undiscounted net cash flow (after tax) for the new machine and determine whether on this basis the old machine should be replaced.

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith