At its Sutter City plant, Yuba Machine Company manufactures nut shellers, which it sells to nut processors

Question:

Plant maximum (theoretical) capacity........................100,000 DLHs

Variable factory overhead costs.................................$3.00 per DLH

Fixed factory overhead costs:

Salaries....................................................................................$ 80,000

Depreciation and amortization...............................................50,000

Other expenses.........................................................................30,000

Total fixed factory overhead...............................................$ 160,000

Based on these data, the predetermined factory overhead application rate was established at $4.60 per direct labor hour (DLH).

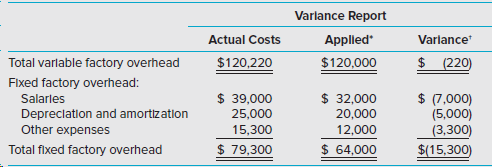

A variance report for the Sutter City plant for the six months ended May 31, 2020, follows. The plant incurred 40,000 DLHs, which represents one-half of the company€™s practical capacity level.

Yuba€™s controller, Sid Thorpe, knows from the inventory records that one-quarter of this period€™s applied fixed overhead costs remain in the Work-in-Process Inventory and Finished Goods Inventory accounts. Based on this information, he has included $48,000 of fixed overhead (i.e., three-quarters of the period€™s applied fixed overhead) as part of the cost of goods sold in the following interim income statement:

YUBA MACHINE COMPANY

Interim Income Statement

For Six Months Ended May 31, 2020

Sales..............................................................$ 625,000

Cost of goods sold..........................................380,000

Gross profit..................................................$ 245,000

Selling expense.................................................44,000

Depreciation expense......................................58,000

Administrative expense...................................53,000

Operating income..........................................$ 90,000

Required

1. Define the term maximum (theoretical) capacity, and explain why it might not be a satisfactory basis for determining the fixed factory overhead application rate. What other capacity levels can be used to set the fixed factory overhead allocation rate? Provide a short definition of each of these alternative capacity levels.

2. Prepare a revised variance report for Yuba Machine Company using practical capacity as the basis for determining the fixed factory overhead application rate. Round each applied overhead cost and each overhead cost variance to the nearest whole dollar. Indicate whether each of the five overhead cost variances in the revised Variance Report is favorable (F) or unfavorable (U).

3. What would Yuba€™s reported (a) cost of goods sold (CGS), and (b) operating income be for the 6 months ending May 31, 2020 if the fixed factory overhead rate is based on practical capacity rather than on maximum capacity? Round each answer to the nearest whole dollar.

4. What capacity level should companies use to determine the factory overhead application rate? Why?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith