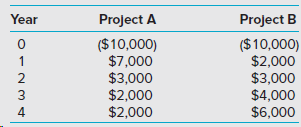

Estimated cashflow data for each of two projects, A and B, and the discount rate, r, to

Question:

Discount rate, r = 10.0%.

Required

1. In a capital budgeting context, explain the difference between independent and mutually exclusive investments. Give an example of each type of investment project. What is the primary implication of this distinction for the analysis of capital investment projects?

2. Use the built-in functions in Excel to calculate the IRR and the NPV for each investment project. Which of these projects€”if either€”should be accepted if they are considered independent projects? Round IRRs to 2 decimal places and NPVs to the nearest whole dollar.

3. An NPV profile for a project is a plot of the project€™s NPV as a function of the discount rate, r, used to determine NPV. Use Excel to prepare a single chart (graph) containing the NPV profile for the two projects, A and B. To generate the plot, use the following values for r: 0%, 4%, 8%, 12%, 16%, and 20%. Interpret each of the following points on your chart: the Y-intercepts; the point at which the two NPV profiles cross each other (defined as the €œcrossover rate€); and the X-intercepts.

4. Of what interpretive value is the chart (graph) you prepared in requirement 3? (Hint: Link the discussion to the situation where projects A and B are mutually exclusive rather than independent. If you could choose only one of these two projects, which would you choose, if either?)

5. What is the primary implication (i.e., take-away) from the preceding analyses, in terms of the capital budgeting process?

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the...

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith