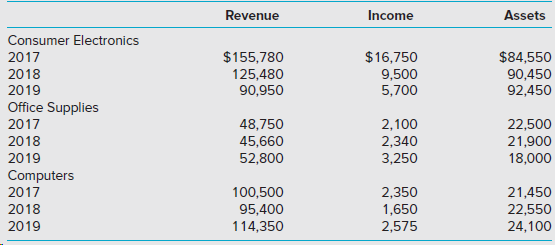

McCoy Brands Inc. (MBI) is a retailer of consumer products. The company made two acquisitions in previous

Question:

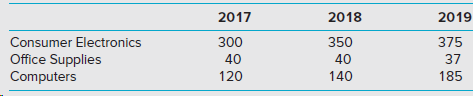

The number of executives covered by MBI€™s current compensation package follows:

The current compensation package is an annual bonus award. Senior executives share in the bonus pool, which is calculated as 10% of the company€™s annual residual income. Residual income is defined as operating income minus an interest charge of 6% of invested assets.

Required

1. Compute asset turnover, return on sales, and return on investment (ROI) for each division and for each year. Use year-end rather than average asset values. Round to 2 decimal places.

2. Use the ratios computed in requirement 1 to explain the differences in profitability of the three divisions.

3. Compute the total bonus amount to be paid during each year; also compute individual executive bonus amounts. Round to the nearest whole dollar.

4. If the bonuses were calculated by divisional residual income, what would the individual bonus amounts be? Round to the nearest whole dollar.

5. Discuss the advantages and disadvantages of basing the bonus on MBI€™s residual income compared to divisional residual income.

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith