Refer to the information in Exercise 20-36. Data from Exercise 20-36 Williams Company is a manufacturer of

Question:

Refer to the information in Exercise 20-36.

Data from Exercise 20-36

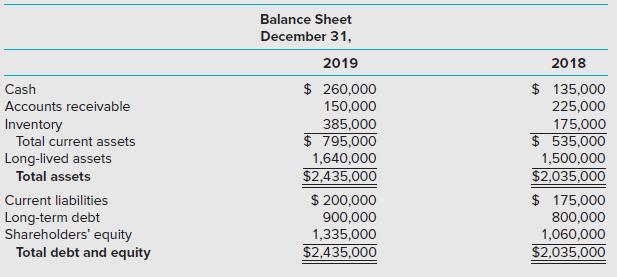

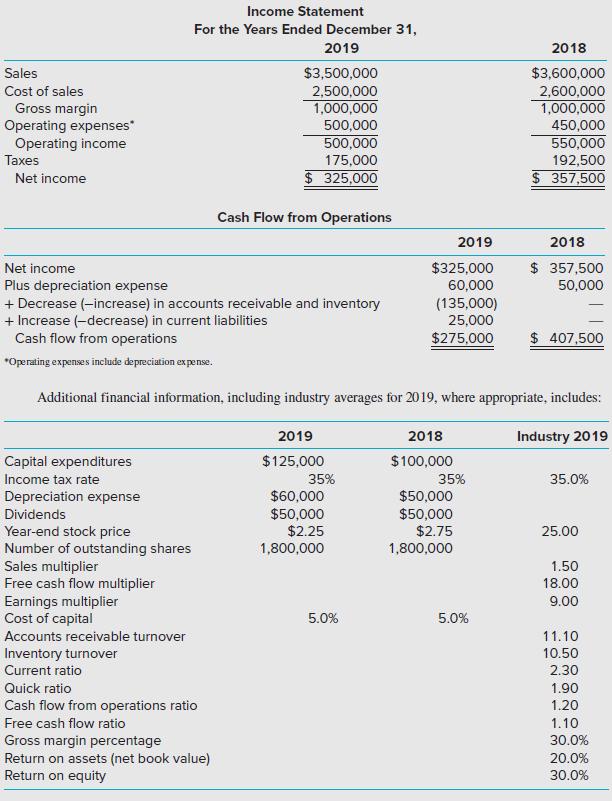

Williams Company is a manufacturer of auto parts having the following financial statements for 2018–2019.

Required

Develop a business valuation for Williams Company for 2019 using the following methods: (1) book value of equity, (2) market value of equity, (3) discounted cash flow (DCF), (4) enterprise value, and (5) all the multiples-based valuations for which there is an industry average multiplier. For the calculation of the DCF valuation, you may use the simplifying assumption that free cash flows will continue indefinitely at the amount in 2019.

Discounted Cash FlowsWhat is Discounted Cash Flows? Discounted Cash Flows is a valuation technique used by investors and financial experts for the purpose of interpreting the performance of an underlying assets or investment. It uses a discount rate that is most...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith

Question Posted: