The XYZ Manufacturing Company produces two products, S-101 and C-110. You have obtained the following information regarding

Question:

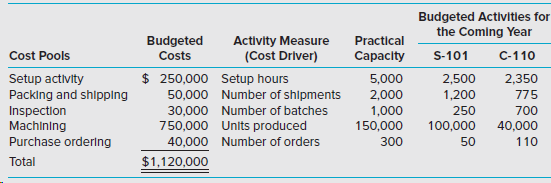

The XYZ Manufacturing Company produces two products, S-101 and C-110. You have obtained the following information regarding the annual manufacturing support (i.e., factory overhead) costs associated with the manufacturing process used to produce these two products:

Required

1. Prepare an Excel spreadsheet that provides activity-based costing (ABC) cost-allocation rates based on budgeted activity units as the denominator activity level for the coming year. (a) What is the budgeted manufacturing support (i.e., factory overhead) cost per unit for S-101? (b) What is the budgeted manufacturing support cost per unit for C-110? (Display each answer to 4 decimal places.)

2. Using your spreadsheet, recalculate the ABC cost-allocation rates, this time based on practical capacity as the denominator activity level. (a) What is the budgeted manufacturing support cost per unit for S-101? (b) What is the budgeted manufacturing support cost per unit for C-110? (Display each answer to 4 decimal places.)

3. Compute, for each cost pool, the difference (rounded to nearest whole dollar) between the budgeted cost for the year and the total cost allocated to production. Label each of these differences (variances) as underapplied or overapplied.

4. How do you interpret the variances (differences) identified in requirement 3?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith