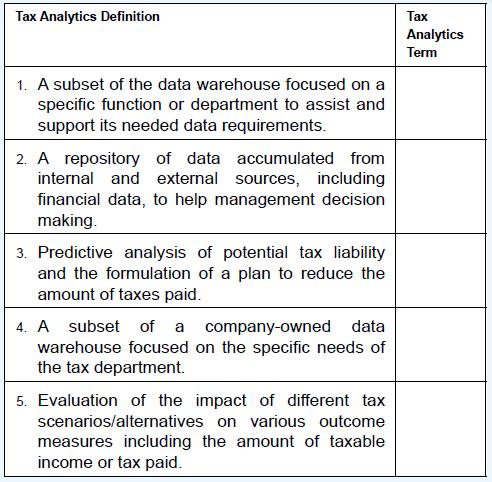

Question: (LO 9-2) Match the tax analytics definitions to their terms: data mart, data warehouse, tax planning, tax data mart, what-if scenario analysis. Tax Analytics Definition

(LO 9-2) Match the tax analytics definitions to their terms: data mart, data warehouse, tax planning, tax data mart, what-if scenario analysis.

Tax Analytics Definition 1. A subset of the data warehouse focused on a specific function or department to assist and support its needed data requirements. 2. A repository of data accumulated from internal and external sources, including financial data, to help management decision making. 3. Predictive analysis of potential tax liability and the formulation of a plan to reduce the amount of taxes paid. Tax Analytics Term 4. A subset of a company-owned data warehouse focused on the specific needs of the tax department. 5. Evaluation of the impact of different tax scenarios/alternatives on various outcome measures including the amount of taxable income or tax paid.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts