Assume the Black-Scholes framework. Consider a portfolio consisting of three European options, X, Y, and Z, on

Question:

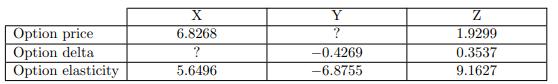

Assume the Black-Scholes framework. Consider a portfolio consisting of three European options, X, Y, and Z, on the same stock. You are given:

Calculate the elasticity of the portfolio.

Transcribed Image Text:

Option price Option delta Option elasticity X 6.8268 5.6496 Y ? -0.4269 -6.8755 Z 1.9299 0.3537 9.1627

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To calculate the elasticity of the portfolio we need to consider the elasticities and the weights of ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The pressures at the ends of 605m long horizontal pipe flow are 350kPa and 270kPa. The pressure at the point between the ends is 300kPa. The pipe is 305mm in diameter and n=0.018 What is the total...

-

Assume that you recently graduated with a major in finance and that you have just landed a job as a financial planner with Barney Smith Inc., a large financial services corporation. Your first...

-

What is the present value of $9,000 received: a. Twenty eight years from today when the interest rate is 10% per year? b. Fourteen years from today when the interest rate is 10% per year? c. Seven...

-

You are the accountant for the South-Western Division of HiValue Grocery Stores. Late in December, Kelly Cholak, the CEO of the Division stops by your office and says I have a couple of questions. I...

-

What types of projects require more detailed analysis in the capital budgeting process?

-

What are some of the nonverbal clues to deception?

-

Stansfield Corporation had the following activities in 2010. 1. Payment of accounts payable.............................$770,000 2. Issuance of common stock..................................$250,000...

-

1. A hollow conducting sphere has an inner and outer radius of R and R2 respectively. A point charge of +Q sits inside the hollow sphere at the center. Additionally, a charge of +2Q is distributed...

-

Assume the Black-Scholes framework. For a 3-month 32-strike European straddle on a stock, you are given: (i) The stock currently sells for $30. (ii) The stocks volatility is 30%. (iii) The stock pays...

-

Assume the Black-Scholes framework. Consider a one-year at-the-money European put option on a nondividend-paying stock. You are given: (i) The ratio of the current put option price to the current...

-

Identify several benefits of the post-audit.

-

Save Answer The frequency of shedding of vortices from a body owing to the flow of fluid past it depends on the length-scale of the body, the speed of the fluid flow, and the density and viscosity of...

-

12. The value of a product offering is determined by the customer and varies accord- ingly. How does a retailer like Walmart deliver value differently than Banana Republic? 13. Explain how Apple...

-

A box of height hand width w is joined along a plane 0. The joint strength has a yield stress, Oy. A force P is applied to the box shown in the diagram below. h = 20mm w = 30mm = 55 degrees P= 150kN...

-

Carbon dioxide levels in the Earth's atmosphere have risen from a pre-1800 baseline of 275 ppm to what average level? O About 500 parts per million CO. O About 400 parts per million CO. O About 600...

-

Practice: 0.100 mol of magnesium metal and a volume of aqueous hydrochloric acid that contains 0.500 mol of HCl are combined and react to completion. How many liters of hydrogen gas, measured at STP,...

-

In 1990, a Japanese investor paid $100 million for an office building in downtown Los Angeles. At the time, the exchange rate was 145/$1. When the investor went to sell the building five years later,...

-

Illini Company, Inc. Balance Sheet as of 12/31/20X0 Assets Current Assets: Cash $1,500,000 Accounts receivable, net 18,000 Inventory 50,000 Total current assets 1,568,000 Equipment 90,000 Goodwill...

-

To repay a $1000 loan, a man paid $91.70 at the end of each month for 12 months. Compute the nominal interest rate he paid.

-

A student bought a $75 used guitar and agreed to pa for it with a single $85 payment at the end of 6 months Assuming semiannual (every 6 months) compounding, what is the nominal annual interest rate?...

-

A firm charges its credit customers 13/4%interest pe month. What is the effective interest rate?

-

DeBleu Products estimated manufacturing overhead costs for the year at $500,000. DeBleu also estimated 8,000 machine hours for the year. DeBleu bases their predetermined manufacturing overhead rate...

-

2. In the following table we have cash flows for two mutually exclusive projects under consideration by your firm. You are asked to evaluate the two projects using both the NPV and IRR rules (applied...

-

Sylvia is married and has four teenage children. She has a detailed retirement plan in place. She is 43 years old and she hopes to retire in 17 years from now when she is 60 by which time her...

Study smarter with the SolutionInn App