Question: Assume the Black-Scholes framework. Consider a special chooser option (also known as an as-you-like-it option) on a nondividend-paying stock. One year from now, its holder

Assume the Black-Scholes framework. Consider a special chooser option (also known as an as-you-like-it option) on a nondividend-paying stock. One year from now, its holder will choose whether it becomes a European gap call option or a European gap put option, each of which will expire three years from now with a strike price of $80 and a payment trigger of $90.

You are given:

(i) The current stock price is $80.

(ii) The risk-free interest rate is 0.

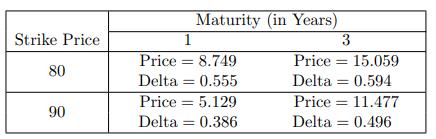

(iii) The following information about European call options on the stock with different strike prices and times to maturity:

Calculate the price of the special chooser option.

Strike Price 80 90 Maturity (in Years) 3 Price: = 15.059 Delta = 0.594 = 1 Price = 8.749 Delta = 0.555 Price = 5.129 Delta = 0.386 Price 11.477 Delta 0.496 =

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

To calculate the price of the special chooser option we need to consider the value of both the Europ... View full answer

Get step-by-step solutions from verified subject matter experts