Question: Assume the Black-Scholes framework. You are given: (i) The current price of a nondividend-paying stock is 20. (ii) The stocks volatility is 28%. (iii) The

Assume the Black-Scholes framework. You are given:

(i) The current price of a nondividend-paying stock is 20.

(ii) The stock’s volatility is 28%.

(iii) The continuously compounded risk-free interest rate is 2%.

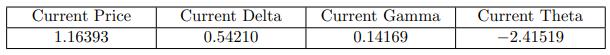

(iv) The following information about a 3-month at-the-money European call option on the stock:

Suppose you have just sold 1,000 units of the call option above. You immediately delta-hedge your position by trading appropriate units of a European put option having the same underlying stock, strike price, and time to expiration as the call option.

Calculate the theta of your overall position.

Current Price 1.16393 Current Delta 0.54210 Current Gamma 0.14169 Current Theta -2.41519

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

By putcall parity the delta and theta of the put option are respectively Ap Op Ac10... View full answer

Get step-by-step solutions from verified subject matter experts