Several years ago, John bought three separate 6-month options on the same stock. Option I was

Question:

Several years ago, John bought three separate 6-month options on the same stock.

• Option I was an American-style put with strike price 20.

• Option II was a Bermudan-style call with strike price 25, where exercise was allowed at any time following an initial 3-month period of call protection.

• Option III was a European-style put with strike price 30.

When the options were bought, the stock price was 20.

When the options expired, the stock price was 26.

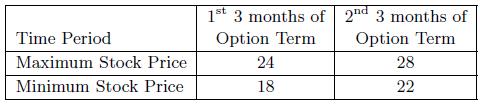

The table below gives the maximum and minimum stock prices during the 6-month period:

John exercised each option at the optimal time.

Rank the three options, from highest to lowest payo.

(A) I > II > III

(B) I > III > II

(C) II > I > III

(D) III > I > II

(E) III > II > I

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: