The current price of a stock is 50. The stock will pay a single dividend of 0.75

Question:

The current price of a stock is 50. The stock will pay a single dividend of 0.75 in one month. The continuously compounded risk-free interest rate is 6%.

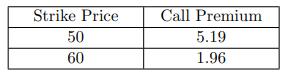

The following table shows the premiums of 6-month European call options on the stock:

Let S be the price of the stock six months from now.

Determine the range of values of S such that a long 50-60 6-month European bear spread outperforms (in terms of profit) a long 50-60 6-month European collar.

Transcribed Image Text:

Strike Price 50 60 Call Premium 5.19 1.96

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Without loss of generality why we may assume that the 5060 bear spread is constructed ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

The current price of a stock is $94, and three-month European call options with a strike price of $95 currently sell for $4.70. An investor who feels that the price of the stock will increase is...

-

You are given: (i) The current price of a stock is $65. (ii) One year from now the stock will sell for either $60 or $70. (iii) The stock pays dividends continuously at a rate proportional to its...

-

ABC Company produces mode trains. During the month of July, it produced 4,000 trains. The actual labor hours were 8 hours per train. Its standard labor hours are 10 hours per train. The standard...

-

How does a corporation determine its deferred taxes under generally accepted accounting principles?

-

1. What type of change(s) occurred at Bayer? 2. What type of employee resistance to change did Bayer have to address? 3. What are the positive and negative lessons learned from how change was handled...

-

Defendant Monty J. Person began working for Garage Solutions, LLC, in March 2015. Three months into his employment, Person was sent by the owner of Garage Solutions, Mark Fontenot, to Rexburg, Idaho,...

-

Ashley's Department Store in Kansas City maintains a successful catalog sales department in which a clerk takes orders by telephone. If the clerk is occupied on one line, incoming phone calls to the...

-

Suppose your starting salary is $50,000. You would like to open a savings account to save for your retirement and any large future expenses. Most Economists agree that you should allocate 20% of your...

-

Apple expects to sell pork bellies 3 months from now. The current 3-month forward price for pork belly is 4 per ton. Apple has decided to buy a zero-cost collar to reduce his exposure to the price of...

-

You are given the following information about four European options on the same underlying asset: (i) The price of a 25-strike 1-year call option is 6.85. (ii) The price of a 35-strike 1-year call...

-

With the same bearing dimensional specifications and fluid viscosity used in Problem 1221, the load now rotates with the journal; i.e. F x = 3000 cos t, F y = 3000 sin t, where = 200 rad/s is the...

-

Assume you have a vertical spring system hanging from a ceiling. Initially, it is in equilibrium. However, if I apply a force and pull the spring downwards, in what direction is the restoring force...

-

If I have a spring constant of k = -15 N/cm, what will be the value of the restoring force if I extend the spring by x = 4 cm? -15 N -60 N -19 N ON

-

A spherical shell contains three charged objects. The first and second objects have a charge of -12.0 nC and 35.0 nC, respectively. The total electric flux through the shell is 638 N-m/C. What is the...

-

Several vectors in the x-y plane are shown in the figure with their tails at the origin of the coordinate system and with a label at their heads. Two of these vectors are given in terms of the...

-

A copper rod of Lc, cross-sectional area Ac, and modulus of elasticity Ec is inserted into an aluminum tube as shown below. The aluminum tube has a cross-sectional area of Aa, modulus of elasticity...

-

Assume that the real risk-free rate is 4 percent and the maturity risk premium is zero. If the nominal rate of interest on one-year bonds is 11 percent, and on comparable-risk two year bonds it is 13...

-

Write a paper detailing a geographic information system (GIS) of your own design that would utilize data in an original manner.

-

Bill purchased a vacation lot he saw advertised on television for an $800 down and monthly payments of $55. When he visited the lot he had purchased, he found it was not something he wanted to own....

-

Compute the rate of return on an investment having the following cash flow. Year Cash Flow 0................................-$850 0.................................+600...

-

Assume that the following cash flows are associated with a project. Year Cash Flow 0........................-$16,000 1............................-8,000 2...........................11,000...

-

What have you learned from the assignments and research that will influence how you lead and coach others in the future? Assignments included researching our leadership, coaching, and conflict...

-

1. Are the following events mutually exclusive? If not, state a common outcome. a. You want to find the probability of drawing a queen or a red card from a deck of cards. b. You want to find the...

-

What steps can you take to sharpen your leadership skills and continue learning (during and after earning my masters degree)?

Study smarter with the SolutionInn App