You are given: (i) An investor short-sells a nondividend-paying stock that has a current price of 44

Question:

You are given:

(i) An investor short-sells a nondividend-paying stock that has a current price of 44 per share.

(ii) This investor also writes a collar on this stock consisting of a 40-strike European put option and a 50-strike European call option. Both options expire in one year.

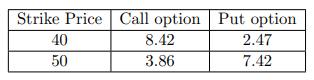

(iii) The prices of the options on this stock are:

(iv) The continuously compounded risk-free interest rate is 5%.

(v) Assume there are no transaction costs.

Calculate the maximum profit for the overall position at expiration.

(A) 2.61

(B) 3.37

(C) 4.79

(D) 5.21

(E) 7.39

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: