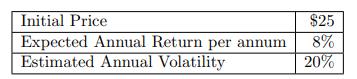

You are given the following information on a stock: Assume that the log returns are normally distributed.

Question:

You are given the following information on a stock:

Assume that the log returns are normally distributed.

(a) Calculate the 95% prediction interval for the stock price in one year.

(b) Calculate the expected stock price and the standard deviation of the stock price in one year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: