Assume that the true formula for pricing options is unknown, e.g., Black-Scholes is not applicable. Hence, you

Question:

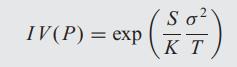

Assume that the true formula for pricing options is unknown, e.g., Black-Scholes is not applicable. Hence, you are asked to use the following approximation for the insurance value of a put option:

Where S is the current price of the stock, K is the strike price, σ is the volatility of the stock return, and T is option maturity.

You are given that S = 100, K = 105, and the interest rate r = 1%. Option maturity is T = 1 year, and there are no dividends.

What is the maximum volatility for which early exercise of the option is induced?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: