Question: Based on the same input parameters as the previous question, price a cap option contract with exercise dates at t = 0.5 and t =

Based on the same input parameters as the previous question, price a cap option contract with exercise dates at t = 0.5 and t = 1, at a strike rate of the half-year interest rate of 5%. Assume the notional on the contract to be $100.

Data in previous question,

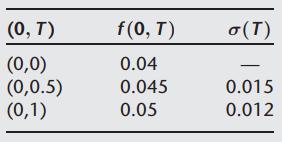

The following table summarizes the initial forward curve for three half-year periods and the initial volatility curve at t = 0. Compute the two forward curves at time t = 0.5 and the three forward curves at time t = 1.

(0, T) (0,0) (0,0.5) (0,1) f(0, T) 0.04 0.045 0.05 o (T) 0.015 0.012

Step by Step Solution

3.56 Rating (167 Votes )

There are 3 Steps involved in it

If we extract the one period spot rates from the calculations ... View full answer

Get step-by-step solutions from verified subject matter experts