Consider a portfolio that has equal amounts of $10 invested in two assets. Suppose returns on the

Question:

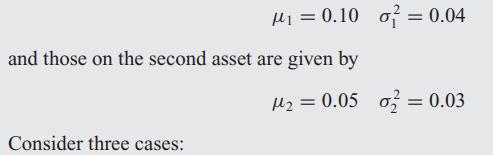

Consider a portfolio that has equal amounts of $10 invested in two assets. Suppose returns on the two assets are jointly normally distributed. The annual expected returns and variance of returns on the first asset are given by

Consider three cases:

(a) The correlation between the returns is ρ = 0.

(b) The correlation between the returns is ρ = +0.50.

(c) The correlation between the returns is ρ = −0.50.

For each case, identify the 99% Value-at-Risk of the portfolio. Explain the pattern of dependence of VaR on the correlation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: