The Beta Chemical Company wants to finance an expansion of one of its production plants by borrowing

Question:

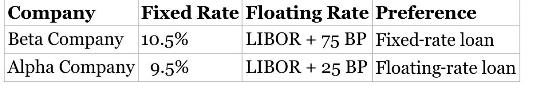

The Beta Chemical Company wants to finance an expansion of one of its production plants by borrowing \(\$ 150\) million for five years. Based on its moderate credit ratings, Beta can borrow five-year funds at a 10.5\% fixed rate or at a floating rate equal to LIBOR + 75 bp. Given the choice of financing, Beta prefers the fixed-rate loan. The Alpha Development Company is also looking for five-year funding to finance its proposed \(\$ 150\) million office park development. Given its high credit rating, suppose Alpha can borrow the funds for five years at a fixed rate of \(9.5 \%\) or at a floating rate equal to the LIBOR \(+25 \mathrm{bp}\). Given the choice, Alpha prefers a floating-rate loan. In summary, Beta and Alphas have the following fixed- and floating-rate loan alternatives:

Questions:

a. Describe Alpha's absolute advantage and each company's comparative advantage?

b. What is the total possible interest rate reduction gain for both parties if both parties were to create synthetic positions with a swap?

c. Explain how a swap bank could arrange a five-year, 9.5\%/LIBOR swap that would benefit both the Alpha and Beta companies. What is the total interest rate reduction gain and how is it split?

Step by Step Answer: