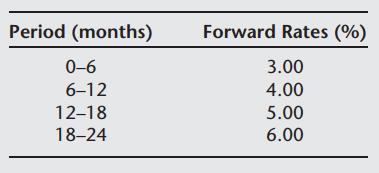

The following market-based FRA rates are provided. Answer the following questions: (a) Find the price of a

Question:

The following market-based FRA rates are provided.

Answer the following questions:

(a) Find the price of a two-year maturity security with a coupon of 4.5%.

(b) Find the price of a six-month bond future on this bond.

(c) What is the price of a twelve-month bond future on this bond?

(d) Find the durations of all the three instruments above.

(e) If we invest $100 in the two-year bond, then how many units of the two futures contracts should we buy such that we have equal numbers of units in each contract, and we optimize our duration-based hedge?

(f) After setting up the hedge, the next instant, the entire forward curve shifts up by 1% at all maturities. What is the change in the value of the hedged portfolio? Is it zero? If not, explain the sign of the change.

Step by Step Answer: