The table shows the annual loan rates that American and British multinational companies can each obtain on

Question:

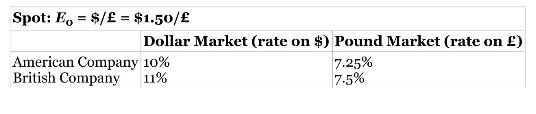

The table shows the annual loan rates that American and British multinational companies can each obtain on a five-year, \(\$ 150\) million loan in dollars and an equivalent five-year, \(£ 100\) million loan in the pounds.

Loan Rates for American and British Companies in Dollars and Pounds

a. Suppose the American multinational wants to borrow \(£ 100\) million for five years to finance its British operations, whereas the British company wants to borrow \(\$ 150\) million for five years to finance its US operations. Explain how a swap bank could arrange a currency swap that would benefit the American company by lowering the rate on its British pound loan by \(0.25 \%\) and would benefit the British company by lowering its dollar loan by \(0.4 \%\).

b. Show the swap arrangement's dollar and pound interest payments and receipts in a diagram.

c. Describe the swap bank's dollar and British pound positions. What is the swap bank's implied forward exchange rate on the contracts?

d. Assume that forward rates are determined by the interest rate parity theorem, that the swap bank can borrow and lend dollars at \(9.5 \%\) and British pounds at 7\%, and that the yield curves for rates in both currencies are flat? Explain how the bank could hedge its swap position using currency forward contracts. What would be the swap bank's profit from it swap and forward positions?

Step by Step Answer: