Question: This question requires you to implement the Das-Sundaram (DS) model presented in the chapter. The notation is the same as that used in the chapter.

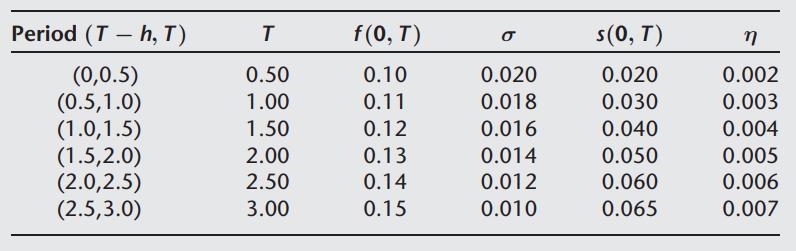

This question requires you to implement the Das-Sundaram (DS) model presented in the chapter. The notation is the same as that used in the chapter. You are given the following table of forward rates and spreads along with their volatilities:

The correlation between spreads and interest rates is −0.30.

(a) Build the tree in interest rates and spreads for five periods using all the data provided above.

(b) Generate another tree with just the probabilities of default at each node on the tree if the recovery rate is taken as two times the short rate at each node.

(c) Use the tree of forward rates and default probabilities to price a three-year semiannual premium credit default swap on the issuer. Express your answer for the premium in basis points credit spread.

Period (Th, T) (0,0.5) (0.5,1.0) (1.0,1.5) (1.5,2.0) (2.0,2.5) (2.5,3.0) T 0.50 1.00 1.50 2.00 2.50 3.00 f(0, T) 0.10 0.11 0.12 0.13 0.14 0.15 0.020 0.018 0.016 0.014 0.012 0.010 s(0, T) 0.020 0.030 0.040 0.050 0.060 0.065 0.002 0.003 0.004 0.005 0.006 0.007

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts