Here is another way to think about outputcredit interlinkage between a trader and a farmer. Recall that

Question:

Here is another way to think about output–credit interlinkage between a trader and a farmer. Recall that the borrower–farmer maximizes his profit. Note that (i) marginal revenue equals price times marginal product of an extra $1 of loan and that(b) marginal cost equals $1 plus the rate of interest on $1.

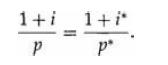

(a) Show that if MP is marginal product, p = price, and i is the rate of interest, then MP = (1 + i)/p.

(b) We argued that the optimal contractual terms must not distort the size of the loan. Show that if p* is the price contracted by the trader and i* is the rate of interest charged by the trader,

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: