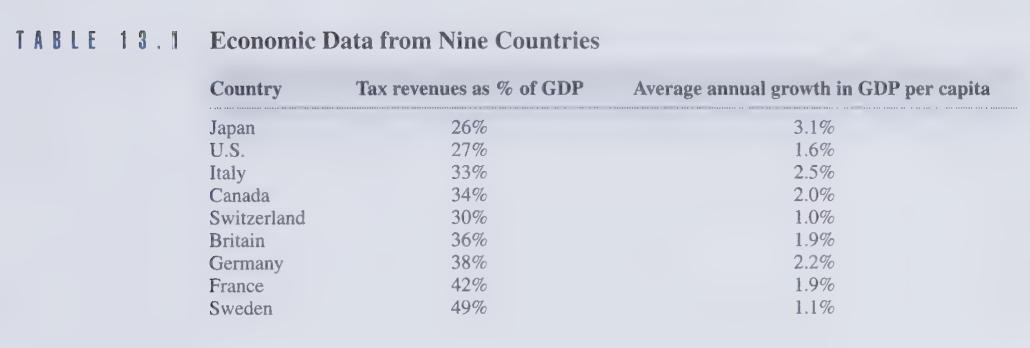

Question: Do increased taxes increase or decrease economic growth? Table 13.1 gives tax revenues as a percentage of Gross Domestic Product (GDP) and the average annual

Do increased taxes increase or decrease economic growth? Table 13.1 gives tax revenues as a percentage of Gross Domestic Product (GDP) and the average annual percentage growth in GDP per capita for nine countries during the years 1970-1994. Do these data support or contradict the dictum of supply-side economics?

TABLE 13.1 Economic Data from Nine Countries Country kate su mumis Japan U.S. Italy Canada Switzerland Britain Germany France Sweden Tax revenues as % of GDP 26% 27% 33% 34% 30% 36% 38% 42% 49% Average annual growth in GDP per capita 3.1% 1.6% 2.5% 2.0% 1.0% 1.9% 2.2% 1.9% 1.1%

Step by Step Solution

3.28 Rating (160 Votes )

There are 3 Steps involved in it

To analyze whether increased taxes increase or decrease economic growth based on the data provided i... View full answer

Get step-by-step solutions from verified subject matter experts