Question: In his study on the labor hours spent by the FDIC (Federal Deposit Insurance Corporation) on 91 bank examinations, R. J. Miller estimated the following

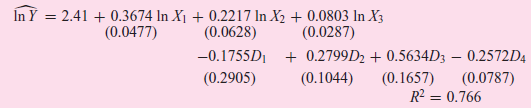

In his study on the labor hours spent by the FDIC (Federal Deposit Insurance Corporation) on 91 bank examinations, R. J. Miller estimated the following function:

Where

Y = FDIC examiner labor hours

X1 = total assets of bank

X2 = total number of offices in bank

X3 = ratio of classified loans to total loans for bank

D1 = 1 if management rating was €œgood€

D2 = 1 if management rating was €œfair€

D3 = 1 if management rating was €œsatisfactory€

D4 = 1 if examination was conducted jointly with the state

The figures in parentheses are the estimated standard errors.

a. Interpret these results.

b. Is there any problem in interpreting the dummy variables in this model since Y is in the log form?

c. How would you interpret the dummy coefficients?

n Y = 2.41 + 0.3674 In X1 + 0.2217 In X2 + 0.0803 In X3 (0.0287) (0.0477) (0.0628) -0.1755D (0.2905) + 0.2799D2 + 0.5634D3 0.2572D4 (0.0787) R? = 0.766 (0.1657) (0.1044)

Step by Step Solution

3.25 Rating (166 Votes )

There are 3 Steps involved in it

a Neglecting the dummies for the moment since this is a double log regression each estimated slope c... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1529_605d88e1d1dd5_656666.pdf

180 KBs PDF File

1529_605d88e1d1dd5_656666.docx

120 KBs Word File