A lending firm is considering six independent and divisible investment alternatives that can be exited with a

Question:

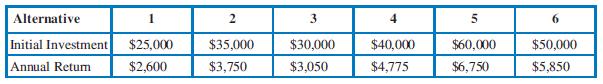

A lending firm is considering six independent and divisible investment alternatives that can be exited with a full refund of the initial investment at any time the firm chooses. A total of $200,000 is available for investment, and the MARR is 10 percent. (Note: There is no planning horizon specified, so the firm can choose any number of years they wish—the optimum portfolio and the IRR will remain the same, since the initial investment and the salvage value are the same, and the annual returns are constant each year.)

a. Determine the optimum portfolio, including which investments are fully or partially selected (if partial, give percentage). You may use Excel®; do not use SOLVER.

b. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage)

selected using (1) the current limit on investment capital, (2) plus 20 percent, and (3) minus 20 percent. Use Excel®

and SOLVER.

c. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage)

selected using (1) the current MARR, (2) plus 20 percent, and (3) minus 20 percent. Use Excel® and SOLVER.

d. Determine the optimum investment portfolio and its PW when Investments 1 through 3 are indivisible and Investments 4 through 6 are divisible. Use Excel® and SOLVER.

e. Determine the optimum investment portfolio when all of the investments are divisible, but fractional investments are limited to 0 percent, 25 percent, 50 percent, 75 percent, or 100 percent. Use Excel® and SOLVER.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt