Consider six mutually exclusive and indivisible investment alternatives being evaluated by Pioneer Cookware in their stainless-steel kitchenware

Question:

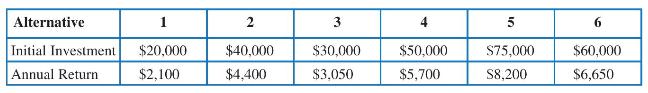

Consider six mutually exclusive and indivisible investment alternatives being evaluated by Pioneer Cookware in their stainless-steel kitchenware group. At the end of 5 years, each investment will end and the initial investment will be fully returned to the investor. Based on the annual returns shown below and a MARR of 10 percent, determine the preferred alternative.

a. Which alternative should Pioneer Cookware select? Use the IRR method to determine the preferred alternative.

b. Use Excel \(\mathbb{R}\) and SOLVER to select the preferred investment based on PW. State both the PW and IRR.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt

Question Posted: