Question: Repeat Problem 67 using payback period with no discounting (PBP). a. What is the payback period for this investment? b. If the maximum attractive PBP

Repeat Problem 67 using payback period with no discounting (PBP).

a. What is the payback period for this investment?

b. If the maximum attractive PBP is 3 years, what is the decision rule for judging the worth of this investment?

c. Should Home Innovations pursue this new product based on PBP?

d. Compare your recommendations resulting from Problems 22, 67, and 68.

Are they consistent? What recommendation would you make to Home Innovations?

Data from problem 22

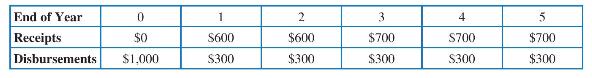

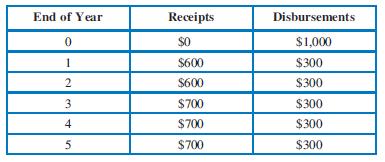

Home Innovation is evaluating a new product design. The estimated receipts and disbursements associated with the new product are shown below. MARR is 10 percent/year.

Data from problem 67

Home Innovations is evaluating a new product design. The estimated receipts and disbursements associated with the new product are shown below. MARR is 10 percent/year.

End of Year 0 1 2 3 4 5 Receipts $0 $600 $600 $700 $700 $700 Disbursements $1,000 $300 $300 $300 $300 $300

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

To calculate the payback period PBP for the investment in Problem 67 well sum the cash flows until t... View full answer

Get step-by-step solutions from verified subject matter experts