Question: Using Table 4.A. 1 as a guide, respond to the following questions based on the 2007 Predicted (beta). a. Which corporation has the lowest volatility?

Using Table 4.A. 1 as a guide, respond to the following questions based on the 2007 Predicted \(\beta\).

a. Which corporation has the lowest volatility?

b. Which corporation has the highest volatility?

c. Consider the three corporations with the three lowest volatilities. What do they have in common?

d. Consider the two corporations with the two highest volatilities. What do they have in common?

e. Which corporation has the largest difference (positive or negative) between its historical and predicted beta? Given the comparative values of the two betas, how would you characterize the "rare event" (positive, negative, or neutral from an investor's perspective)?

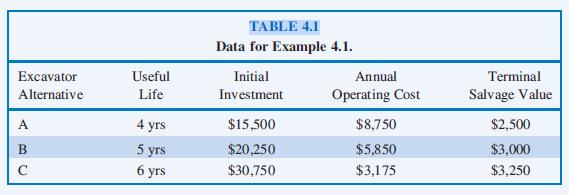

TABLE 4.1 Data for Example 4.1. Excavator Useful Alternative Life Initial Investment Annual Operating Cost Terminal Salvage Value A 4 yrs $15,500 $8,750 $2,500 B 5 yrs $20,250 $5,850 $3,000 C 6 yrs $30,750 $3,175 $3,250

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

To answer these questions based on the given data from Table 41 we need to understand that beta is a measure of the volatility or systematic risk of a ... View full answer

Get step-by-step solutions from verified subject matter experts