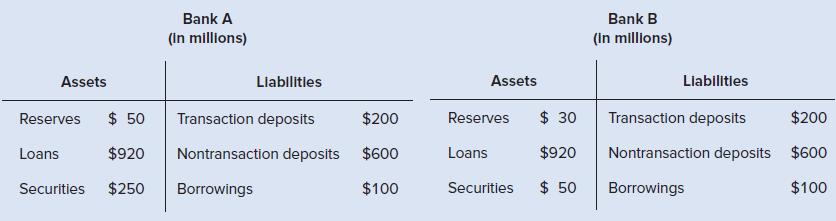

Consider the balance sheets of Bank A and Bank B. Suppose that reserve requirements are 10 percent

Question:

Consider the balance sheets of Bank A and Bank B. Suppose that reserve requirements are 10 percent of transaction deposits and both banks have equal access to the interbank market and funds from the Federal Reserve.

a. Which bank appears to face a greater liquidity risk?

b. Which bank appears to face a greater risk of insolvency? What other information might you use to assess the risk of insolvency of these banks?

Explain your answers.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Money Banking And Financial Markets

ISBN: 9781260226782

6th Edition

Authors: Stephen Cecchetti, Kermit Schoenholtz

Question Posted: