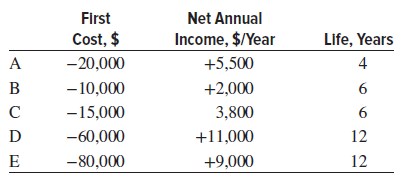

Question: A mechanical engineer at Anode Metals is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives.

(a) If they are independent,

(b) If they are mutually exclusive.

(c) Explain why your selection in part (b) is correct.

First Net Annual Cost, $ Income, $/Year Life, Years A -20,000 +5,500 4 +2,000 B - 10,000 -15,000 3,800 D -60,000 +11,000 12 -80,000 +9,000 12

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

a Select C and D with i values exceeding MARR rows 21 and 22 b c Select C It is the alternative with ... View full answer

Get step-by-step solutions from verified subject matter experts