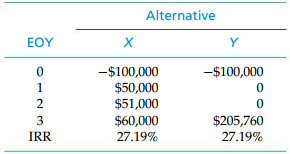

Consider the following two mutually exclusive alternatives for reclaiming a deteriorating inner-city neighborhood (one of them must

Question:

a. If MARR is 15% per year, which alternative is better?

b. What is the IRR on the incremental cash flow [i.e., ˆ†(Yˆ’X)]?

c. If the MARR is 27.5% per year, which alternative is better?

d. What is the simple payback period for each alternative?

e. Which alternative would you recommend?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted: