Question: Five independent projects were ranked in decreasing order by two measuresrate of return (ROR) and present worth (PW)to determine which should be funded with the

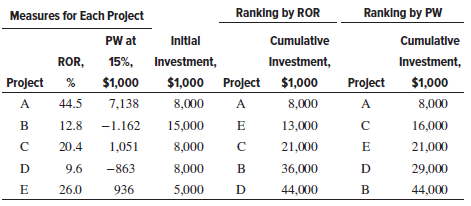

Five independent projects were ranked in decreasing order by two measures€”rate of return (ROR) and present worth (PW)€”to determine which should be funded with the total initial investment not to exceed $30 million.

(a) Use the results below to determine the opportunity cost in ROR terms for each measure.

(b) If a MARR of 15% per year is a firm requirement, how does the opportunity cost help in selecting projects to fund?

Ranking by ROR Ranklng by PW Measures for Each Project PW at Inltlal Cumulative Cumulative ROR, 15%, Investment, Investment, Investment, $1,000 $1,000 Project $1,000 $1,000 Project Project 8,000 A 44.5 7,138 A 8,000 A 8,000 B 12.8 -1.162 15,000 13,000 16,000 20.4 1,051 21,000 8,000 21,000 -863 8,000 29,000 D 9.6 36,000 26.0 936 5,000 44,000 44,000

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

a ROR measure Select projects A E and C to total 21 million Opportun... View full answer

Get step-by-step solutions from verified subject matter experts