Question: For the FOUNDATION Fieldbus H1 installation analyzed in Problem 9.27, do the following: (Data is repeated below.) (a) Find the PI for the first 6

For the FOUNDATION Fieldbus H1 installation analyzed in Problem 9.27, do the following: (Data is repeated below.)

(a) Find the PI for the first 6 years of operation.

(b) Find the required ΔNCF for next year if Dickinson plans to invest an additional $150,000 in year 7 and wants to realize an increase in profitability such that PI = 1.20.

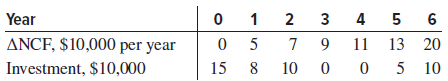

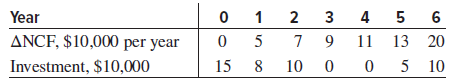

Data from problem 9.27

Dickinson, a large oil and gas drilling and operating corporation, has invested over the past 6 years in the installation and operation of a FOUNDATION Fieldbus H1 (FF H1) system developed by Pepperl+Fuchs of Germany. A project engineer has collected information on annual net cash flow increases (ΔNCF) generated by the FF H1 system and the annual investments made by Dickinson in the system. At an interest rate of 10% per year, determine the PI of this endeavor. Has it proven to be economically worthwhile?

Year 3 2 4 5 ANCF, $10,000 per year Investment, $10,000 11 13 20 15 10 5 10 Year ANCF, $10,000 per year Investment, $10,000 3 4 7 9 11 13 20 10 0 0 5 10 5 15

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

All monetary units are 10000 a PI computation 6 years b Goal Seek finds year 7 NCF 2419 f... View full answer

Get step-by-step solutions from verified subject matter experts