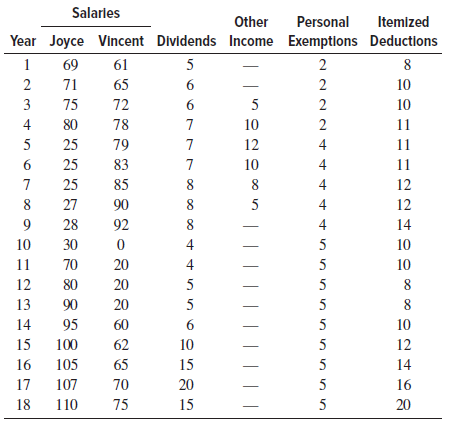

Question: Joyce and Vincent, both engineers, got married and raised three children over an 18-year period and the first one is now ready for college. There

The two have summarized the basic information from their tax returns for the 18 years. They wonder what percentage of their gross income has gone to federal taxes over the years. Apply the tax rate in the latest IRS Publication 17 (www.irs.gov) for married, filing jointly to calculate their taxes each year using a spreadsheet and plot the percentage of GI.

Assume exemptions are deducted as follows for each person (adult or child): years 1 to 8, $3500; years 9 to 14, $4000; years 15 to 18, $4500. (All monetary amounts are in $1000 units.)

Salarles Other Personal Itemized Year Joyce Vincent Dividends Income Exemptlions Deductions 1 69 61 5 71 65 2 10 3 75 72 6. 5 10 4 80 78 10 2 11 25 79 12 4 11 25 83 10 4 11 25 85 12 27 90 5 4 12 28 92 14 10 30 5 10 11 70 20 5 10 12 80 20 5 13 90 20 5 14 95 60 10 15 100 62 10 5 12 16 105 65 5 14 17 107 70 20 16 18 110 75 20

Step by Step Solution

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Tax rates for 2015 from IRS Publication 17 are belo... View full answer

Get step-by-step solutions from verified subject matter experts