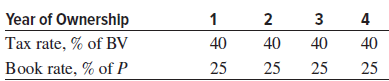

Question: Quantum Electronic Services paid P = $40,000 for its networked computer system. Both tax and book depreciation accounts are maintained. The annual tax recovery rate

Quantum Electronic Services paid P = $40,000 for its networked computer system. Both tax and book depreciation accounts are maintained. The annual tax recovery rate is based on the previous year€™s book value (BV), while the book depreciation rate is based on the original first cost (P). Use the rates listed below to calculate

(a) Annual depreciation,

(b) Book values for each method.

Tax depreciation: Dt = Rate × BVt€“1

Book depreciation: Dt = Rate × P

Year of Ownershlp Tax rate, % of BV Book rate, % of P 3 4 40 40 40 25 25 40 25 25 2.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Tax depreciation D t RateBV t1 Book depreciat... View full answer

Get step-by-step solutions from verified subject matter experts