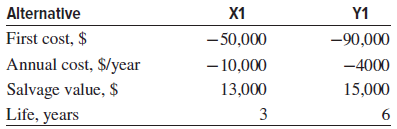

Question: The estimates for two alternatives are to be compared on the basis of their perpetual equivalent annual worth. At an interest rate of 10% per

(a) AWY1 = ˆ’90,000(0.10) ˆ’ 4000 + 15,000(0.10)

(b) AWY1 = ˆ’90,000(0.10) ˆ’ 4000 + 15,000(Aˆ•F,10%,6)

(c) AWY1 = ˆ’90,000(0.10) ˆ’ 4000 ˆ’ 15,000(Pˆ•F,10%,3)(0.10) + 15,000(0.10)

(d) AWY1 = ˆ’90,000(Aˆ•P,10%,6) ˆ’ 4000 + 15,000(Aˆ•F,10%,6)

Alternative Y1 X1 First cost, $ Annual cost, $/year Salvage value, $ - 50,000 -90,000 - 10,000 -4000 13,000 3 15,000 6. Life, years

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

d AW Y1 ... View full answer

Get step-by-step solutions from verified subject matter experts