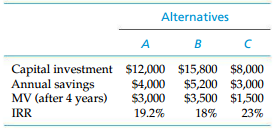

The Ford Motor Company is considering three mutually exclusive electronic stability control systems for protection against rollover

Question:

Plot the AW of each alternative against MARR as the MARR varies across this range: 4%, 8%, 12%, 16%, and 20%. What can you generalize about the range of the MARR for which each alternative is preferred?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Engineering Economy

ISBN: 978-0133439274

16th edition

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Question Posted: