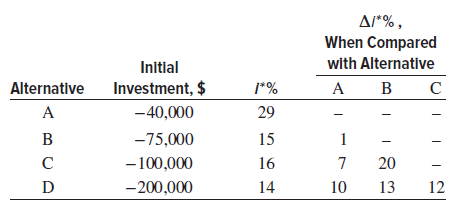

Question: The four alternatives described below are being evaluated by the rate of return method. (a) If the proposals are independent, which should be selected at

The four alternatives described below are being evaluated by the rate of return method.

(a) If the proposals are independent, which should be selected at a MARR of 16% per year?

(b) If the proposals are mutually exclusive, which one should be selected at a MARR of 9% per year?

(c) If the proposals are mutually exclusive, which one should be selected when the MARR is 12% per year?

AI*%, When Compared with Alternative Initial B C Investment, $ Alternative 1*% A -40,000 A 29 -75,000 B 15 1 -100,000 16 20 D -200,000 14 10 13 12

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

a Proposals are independent Select A and C b Alternative ... View full answer

Get step-by-step solutions from verified subject matter experts