Question: Using the data from Problem 6-7, create a spreadsheet to identify the best design using an IRR analysis. Data from Problem 6-7: Three mutually exclusive

Data from Problem 6-7:

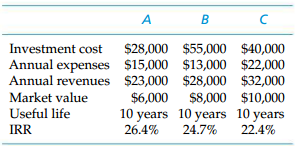

Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given next. The MARR is 20% per year. At the conclusion of the useful life, the investment will be sold.

A decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation using the PW method.

$28,000 $55,000 $40,000 Annual expenses $15,000 $13,000 $22,000 Annual revenues $23,000 $28,000 $32,000 $8,000 $10,000 10 years 10 years 10 years Investment cost Market value Useful life $6,000 IRR 26.4% 24.7% 22.4%

Step by Step Solution

3.31 Rating (166 Votes )

There are 3 Steps involved in it

Invest in alternative B Investment cost Annual expenses Annual revenues Market value Usefu... View full answer

Get step-by-step solutions from verified subject matter experts