Question: Work Problem 6-38 by using the internal rate of return (IRR) method. The MARR is 15% per year. Remember to think incrementally! Data from Problem

Data from Problem 6-38:

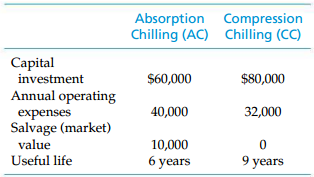

Two mutually exclusive alternatives for office building refrigeration and air conditioning are being investigated. Their relevant costs and lives are summarized as follows:

If the hurdle rate (MARR) is 15% per year and the study period is 18 years, which chilling system should be recommended?

Absorption Compression Chilling (AC) Chilling (CC) Capital investment $80,000 $60,000 Annual operating 40,000 32,000 expenses Salvage (market) value 10,000 9 years Useful life 6 years

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Below are the incremental cash flows of delta CCAC over the 18year study perio... View full answer

Get step-by-step solutions from verified subject matter experts