You have been asked to compare the alternatives on the basis of a present worth comparison. The

Question:

(a) $ˆ’724,320

(b) $ˆ’530,520

(c) $ˆ’388,950

(d) $ˆ’72,432

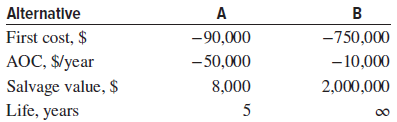

Problem is based on the following cash flows for alternatives A and B at an interest rate of 10% per year.

Transcribed Image Text:

Alternative First cost, $ AOC, $/year Salvage value, $ Life, years B -90,000 -750,000 - 50,000 -10,000 2,000,000 8,000 5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

LCM is first find AW and then di...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

You have been asked to compare the sales and assets of four companies that make computer chips to determine which company is the largest in each category. You have gathered the following data, but...

-

You have been asked to compare the sales and assets of four companies that make computer chips to determine which company is the largest in each category. You have gathered the following data, but...

-

You have been asked to compare three alternative investments and make a recommendation. Project A has an initial investment of $5 million and after-tax cash flows of $2.5 million a year for the next...

-

An individual can deduct for tax purposes the interest expense incurred on the mortgage loan attached to his or her personal residence. Is this statement true? Explain.

-

Marisa and Jennifer both attempted to put away $10,000 a year toward savings. Marisa used a 401(k) pension plan while Jennifer tried to do the same but was forced to pay taxes on that $10,000 in...

-

For the pizza seller whose marginal, average variable, and average total cost curves are shown in the accompanying diagram, what is the profit-maximizing level of output and how much profit...

-

An electronic instrument of mass \(10 \mathrm{~kg}\) is mounted on an isolation pad. If the base of the isolation pad is subjected to a shock in the form of a step velocity of \(10 \mathrm{~mm} /...

-

A condensed income statement by product line for Celestial Beverage Inc. indicated the following for Star Cola for the past year: Sales .............. $ 290,000 Cost of goods sold ......... 155,000...

-

Analyze the implications of non-volatile memory (NVM) and persistent memory on traditional memory management practices. How do these technologies change the landscape of data persistence and recovery...

-

ErgoFurn, Inc. manufactures ergonomically designed computer furniture. ErgoFurn uses a job order costing system. On November 30, the Work in Process Inventory consisted of the following jobs: On...

-

An engineer analyzed four independent alternatives by the present worth method. On the basis of her results, the alternative(s) she should select are: (a) Only D (b) Cant tell from this information...

-

The present worth of alternative B is nearest: (a) $85,000 (b) $750,000 (c) $850,000 (d) $950,000 Problem is based on the following cash flows for alternatives A and B at an interest rate of 10% per...

-

The relationship between the height and the diameter of a tree is approximately determined by the equation f (x) = kx3/2, where x is the height in feet, f (x) is the diameter in inches, and k is a...

-

Trace the curves in Problems 27-32 onto your own paper and draw the secant line passing through \(P\) and \(Q\). Next, imagine \(h ightarrow 0\) and draw the tangent line at \(P\) assuming that \(Q\)...

-

Table 18.5 shows the gross national product (GNP) in trillions of dollars for the years 1960-2012. Find the average yearly rate of change of the GNP for the requested years in Problems 19-26. Table...

-

In Problems 21-38, guess the requested limits. \(\lim _{n ightarrow \infty} \frac{54,500}{5 n}\)

-

Show that \(\frac{1}{2} x^{2}-5\) is an antiderivative of \(x\).

-

Table 18.5 shows the gross national product (GNP) in trillions of dollars for the years 1960-2012. Find the average yearly rate of change of the GNP for the requested years in Problems 19-26. Table...

-

Consider the following transportation matrix that has an initial feasible solution obtained using the northwest corner rule. It is impossible to apply the stepping stone method to this matrix in its...

-

Saccharin is an artificial sweetener that is used in diet beverages. In order for it to be metabolized by the body, it must pass into cells. Below are shown the two forms of saccharin. Saccharin has...

-

In June 2008, your company traded-in a used car with a BV of $5,000. The vendor, having accepted the older car as a trade-in, was willing to make a deal and offered to sell you a new car with an MV...

-

A concrete and rock crusher for demolition work has been purchased for $60,000, and it has an estimated SV of $10,000 at the end of its five-year life. Engineers have estimated that the following...

-

During a particular year, a corporation has $18.6 million in revenue, $2.4 million of operating expenses, and depreciation expenses of $6.4 million. What is the approximate federal tax this...

-

Iguana, Incorporated, manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to...

-

Why does the government intervene in the economy? Explain two ways the government seeks to direct the economy in a mixed economic system like the United States. How can ordinary citizens influence...

-

What strategies do businesses have in place that promote equal opportunity within the organization? Do most businesses offer career development and training to its employees? If so, why? How do...

Study smarter with the SolutionInn App