Lets say that New Venture Fitness Drinks was interested in hiring a new chief executive officer (CEO)

Question:

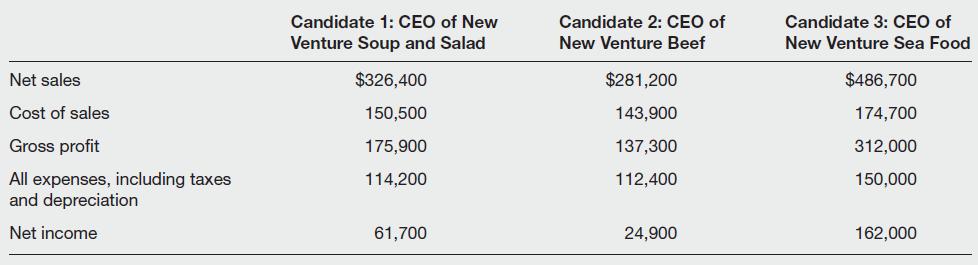

Let’s say that New Venture Fitness Drinks was interested in hiring a new chief executive officer (CEO) and was interviewing the CEOs of three small restaurant chains. To get a sense of how savvy each candidate was at managing a firm’s finances, the board of directors of New Venture Fitness Drinks asked each person to submit the 2011 income statement for his or her current firm. An analysis of an abbreviated version of each firm’s income statement is shown here.

By glancing at these statements, it would appear that the shrewdest financial manager of the three is the CEO of New Venture Sea Food. The company’s net income is more than double that of the other two firms. In addition, New Venture Sea Food’s cost of sales was 35.9 percent of net sales in 2011, compared to 46.1 percent for New Venture Soup and Salad and 51 percent for New Venture Beef. Similarly, New Venture Sea Food’s expenses were 30.9 percent of sales, compared to 35.0 percent for New Venture Soup and Salad and 40 percent for New Venture Beef.

Fortunately, one of the board members of New Venture Fitness Drinks asked a series of questions during the personal interviews of the candidates and uncovered some revealing information. As it turns out, New Venture Sea Food was in the hottest segment of the restaurant industry in 2011. Seafood restaurants of comparable size produced about 1.5 times as much net income as New Venture Sea Food did. So if candidate 3 had done his job properly, his company’s net income should have been in the neighborhood of $240,000 instead of $162,000. New Venture Soup and Salad was in a slow-growth area and at midyear feared that it might not meet its financial targets. So the CEO pulled several of his best people off projects and reassigned them to marketing to develop new menu items. In other words, the company borrowed from its future to make its numbers work today.

As for New Venture Beef, the CEO found herself in a market that was losing appeal. Several reports that gained national publicity were published early in the year warning consumers of the risks of eating red meat. To compensate, the CEO quickly implemented a productivity improvement program and partnered with a local beef promotion board to counter the bad press with more objective research results about beef’s nutritional value. The company also participated in several volunteer efforts in its local community to raise the visibility of its restaurants in a positive manner. If the CEO of New Venture Beef hadn’t moved quickly to take these actions, its 2011 performance would have been much worse.

Ultimately, New Venture Fitness Drinks decided that candidate 2, the CEO of New Venture Beef, was the best candidate for its job. This example illustrates the need to look at multiple years of an income statement rather than a single year to fairly assess how well a firm is performing financially. It also illustrates the need to look beyond the numbers and understand the circumstances that surround a firm’s financial results.

Questions for Critical Thinking

1. Show the income statements for the three candidates to two or three friends who are majoring in business. Ask them to select the best CEO from among these three people on the basis of these income statements. In addition, ask your friends to explain their choices to you. Did your friends choose the same candidate? If not, what do you think caused the differences in their choices?

2. Based on material presented in this chapter, earlier chapters in this book, and your general business knowledge, where would you go to find information about the growth of the different segments of the restaurant industry? Where would you go to find information about the profitability of the restaurant industry in general?

3. What would have been the appropriate financial information to request from the three candidates for the job?

4. What are the three most important insights you gained from studying this feature? Which of these insights surprised you, and why?

Step by Step Answer:

Entrepreneurship Successfully Launching New Ventures

ISBN: 9780132555524

4th Edition

Authors: Bruce R. Barringer, R. Duane Ireland