This plan contains 18 months of projections. While we believe that the assumptions underlying the projections are

Question:

This plan contains 18 months of projections. While we believe that the assumptions underlying the projections are reasonable, there can be no assurance that these results can be realized, the nature of the underlying assumption will stay the same, or that actual results will meet expectations.

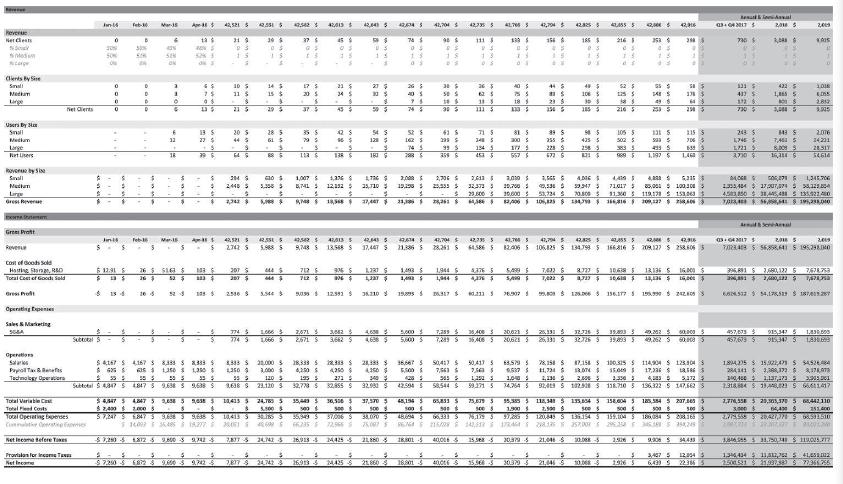

Top Down vs. Bottom Up Financials Gravyty believes that “bottom-up” financial analysis is the best approach to business planning. This is in contrast to “top-down” analysis, which states the percentage of a given total addressable market (TAM) an entrepreneur thinks can be captured. Bottom up financials allow us to think client‐byclient, month‐by‐month about the strategies and personnel necessary to build the business.

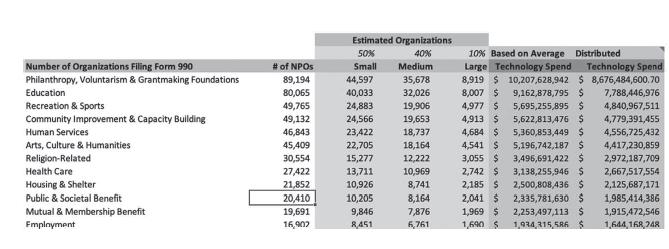

Nonprofits in the United States are required to file a Form 990 with the Internal Revenue Service (IRS) in order to maintain their status. Within the Form 990, is a National Taxonomy of Exempt Entities (NTEE) code, which is used by the IRS to classify these organizations into 24 different groups. Management has chosen to focus initially on those segments in the chart below for their bottom up approach based on size of the market, access to early adopters, and the initial perceived need based on the value proposition.

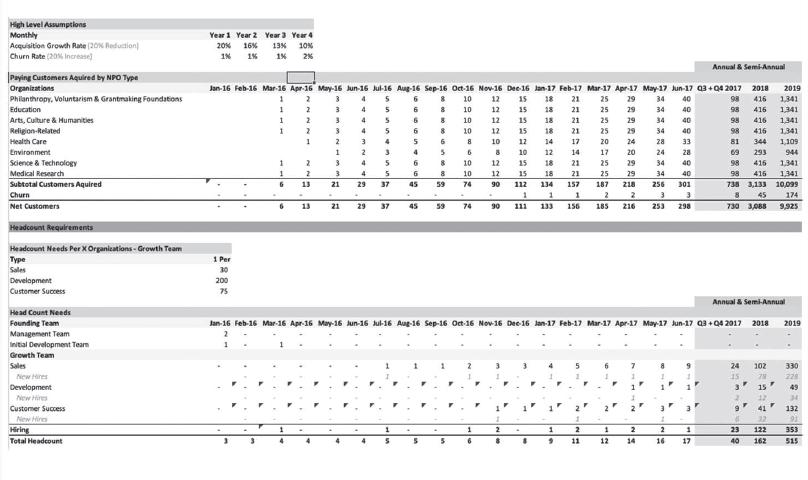

Customer Acquisition Given the high touch nature of the business, we chose to control early growth to maximize learning over revenue. Given our domain expertise, we had several existing connections to organizations who would be beta testers and potential early clients.

However, we decided that we would only believe we were onto something when the first “stranger” bought for “full price.” This means a customer would buy their services based on the merits of the value proposition and realization, rather than as a favor.

When thinking about customer acquisition, we want to plan carefully around personnel numbers. Since our intention is to raise outside capital for the business, we tested for a breaking point. Could a customer success manager handle 25, 50, 75, or 100+ customers before quality or morale is impacted? We also believe that after an early investment in R&D, the business would scale based on an inside and outside sales team.

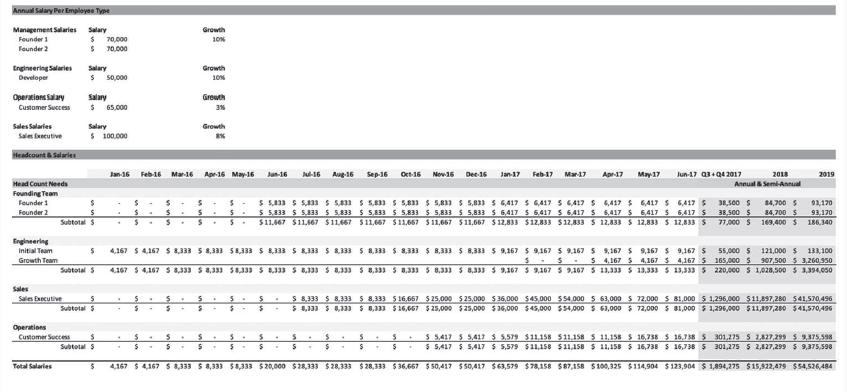

Headcount

Based on our customer acquisition schedule and the headcount needs to support these customers, we put together an estimated cost schedule for salaries to bring into the Income Statement. Initially, these would be the main costs for the business, so it was important to keep them in check to extend runway of initial capital investments.

Cost Assumptions

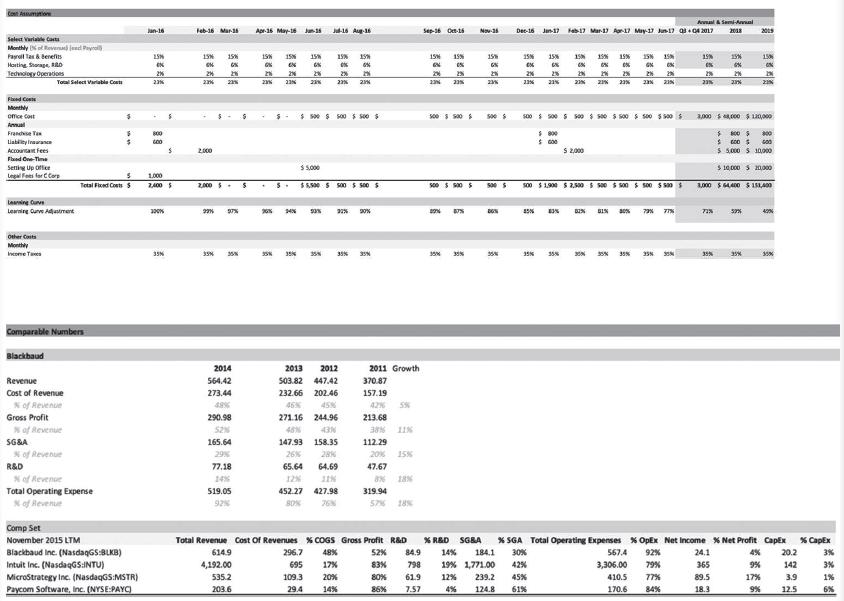

We model both variable and fixed costs for the business. These were often aggregate percentage numbers that were used to simplify some complexity within the financial model—so long as they could find rule‐of‐thumb numbers or reasonable comparables.

We used a learning curve as a means to quantify efficiency.

Through time, we believe we will get better and faster at various processes, which will bring down costs.

We also believe that R&D as a percentage of Revenue will be on the lower end because most of the “R&D” costs will be tied up in Developer salaries. Similarly, we believe that SG&A percentages will be on the lower end of comparable companies due to initial sales/advertising efforts focused on the existing networks of the founding team and the word‐of‐mouth nature of product adoption within nonprofit sector.

Income Statement Assumptions

As with many sectors of the economy, the nonprofit industry is comprised of small, medium, and large organizations. There are about 1.5M nonprofits in the United States and 10M nonprofits globally.

The distribution of these organization is a hierarchy, with the greatest number of nonprofits in the “small” category, and the large amount of assets under management (AUM) consolidated in “large”

organizations. Small organizations are often nimbler in their ability to try new products, but their budgets are smaller, and they may lack sophistication. Large organizations have bigger budgets, but the sales cycles may be slower due to larger implementations and more layers of sign off before committing to purchase decisions.

Valuation

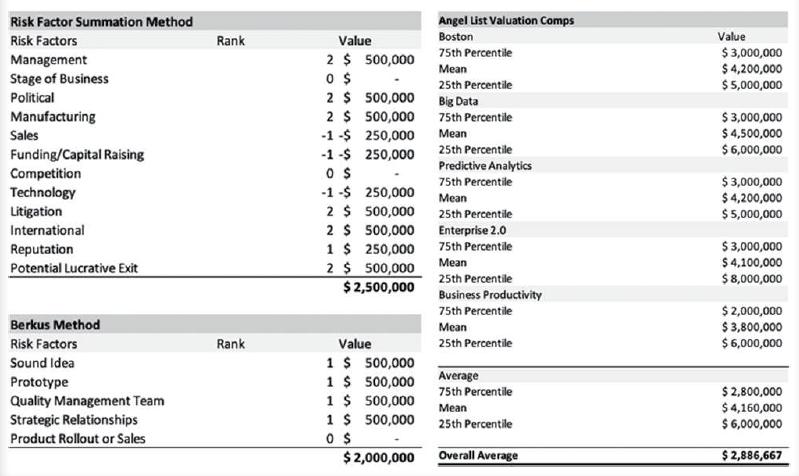

The idea of valuation, especially at the earliest stage is more “art” than “science.” As such, we want to approach the question of valuation from several different angles.

• Frameworks. Two high‐level approaches in the Risk Factor Summation Model as well as the Berkus Method for early‐stage valuations. By nature, these are directionally correct rather than specific.

• Comparables. A look at public information about venture capital deals that had been done within the industry and our city.

• Discounted Cash Flow (DCF). A DCF analysis to see if there would be interesting insights gleaned.

We are seeking \($500k\) in funding and believe that an early sale of 20% of the business would leave ample upside potential while giving enough runway to gain significant traction.

As all entrepreneurs do, we also calculate what a potential exit would look like, and model valuation based off both Revenue and Net Income multiples achieved by the end of 2019.

Discussion Questions

1. What questions would investors likely have?

2. How well does the Executive Summary tie back to the financial projections of the business? Is there anything from the Financials that should have been included in the Executive Summary to paint a clearer picture of the business?

3. Given the different segments of this market listed on the first chart, what questions would you ask to figure out which market(s) to focus on launching in first?

4. Do the assumptions for headcount pass the “common sense”

check? For example, does it make sense to have one customer success person per 75 customers? Would you wait 11 months to make this hire as the company is suggesting?

5. Given the founding team of 3, what strategies might the team use to hire 6 people within the first year (1 Developer, 1 Customer Success, 4 Sales)?

6. What are the differences between the risk factor summation method, Berkus method, and Angel List comparable valuation methods? How much should this business be valued at?

7. Why are there big deviations within valuations for some of the comparables? What do you think contributes to that?

What is within the entrepreneur’s control to influence these valuations?

8. Gravyty is looking to raise \($500,000\) at a \($2.25M\) pre‐money valuation. Does this seem appropriate? Why or why not?

Step by Step Answer: