Consider instances when a pollution tax is equivalent to an output tax by examining the following: (a)

Question:

Consider instances when a pollution tax is equivalent to an output tax by examining the following:

(a) Suppose a firm’s cost function satisfies assumption 5.2. Show that in this case, an emissions tax is equivalent to a sales tax.

Determine the optimal sales tax.

(b) Suppose now that a firm’s cost function satisfies assumption 5.1.

Show that it is in general not possible to achieve a first-best allocation by charging a sales tax.

(c) Determine the comparative static effect from increasing the output tax. Derive signs for the change in firm’s output, emissions, and the market price.

(d) Determine the second-best optimal output tax when firms are symmetric.

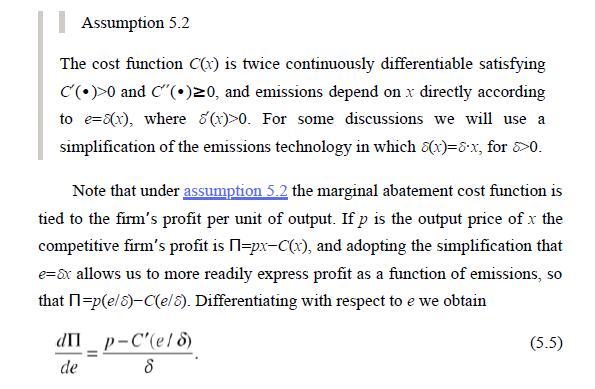

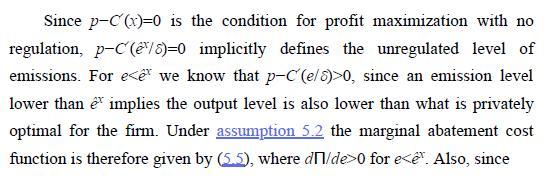

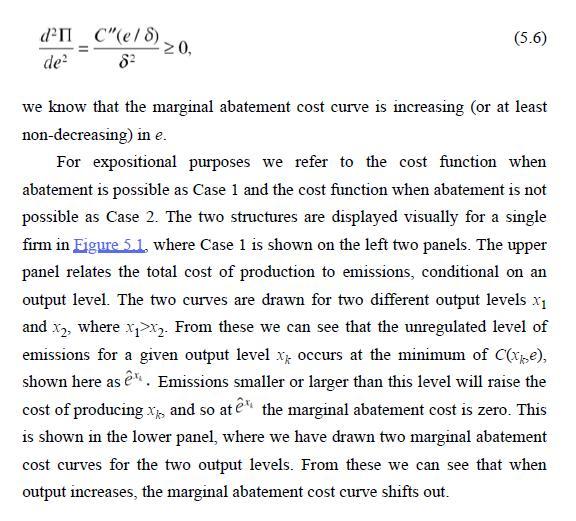

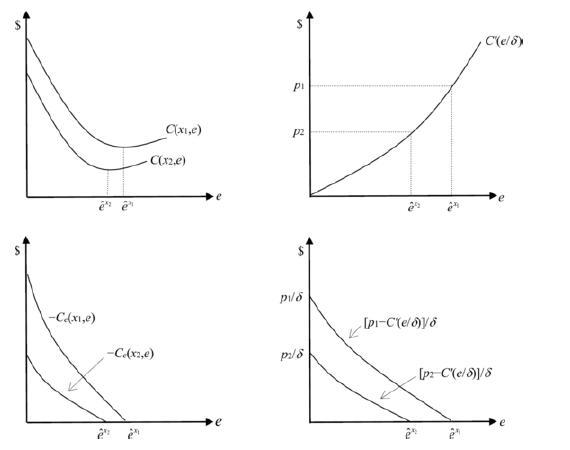

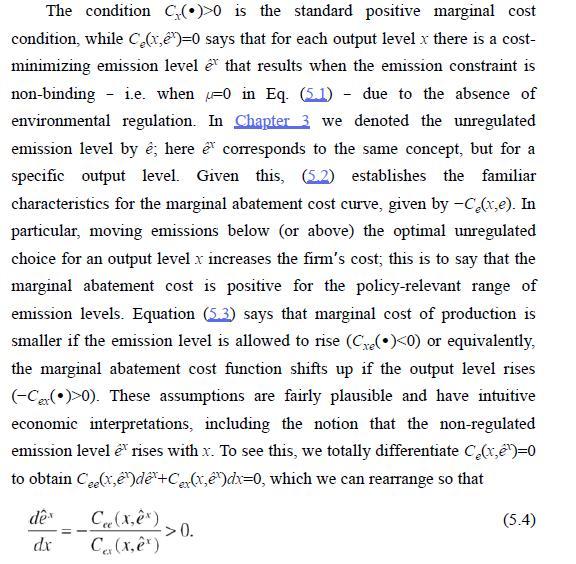

Data from assumption 5.2

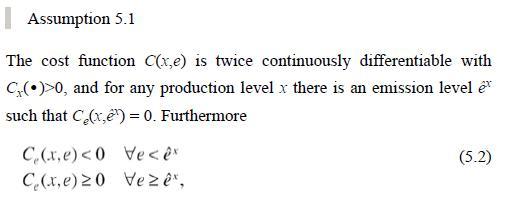

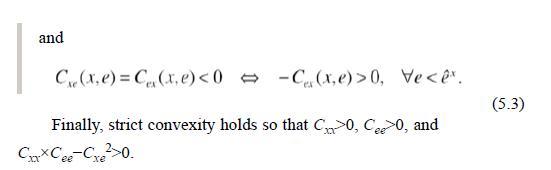

Data from assumption 5.1

Step by Step Answer:

A Course In Environmental Economics

ISBN: 9781316866818

1st Edition

Authors: Daniel J Phaneuf, Till Requate