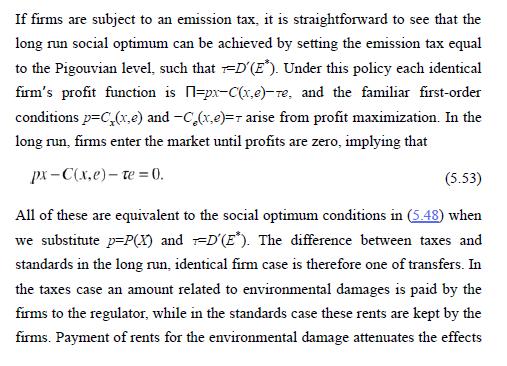

In contrast to our analysis in Section 5.4.3, Carlton and Loury (1980) suggest that a Pigouvian tax

Question:

In contrast to our analysis in Section 5.4.3, Carlton and Loury (1980) suggest that a Pigouvian tax alone will not lead to a long run social optimum for competitive polluting firms. Using their arguments, show that when the damage function is D(E,J), depending on both emissions and the number of firms, an entry tax or subsidy is needed to reach the long run social optimum.

Data from section 5.4.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

A Course In Environmental Economics

ISBN: 9781316866818

1st Edition

Authors: Daniel J Phaneuf, Till Requate

Question Posted: